does idaho have capital gains tax

Your capital gain income is not taxable by California because the source of the gain is Idaho. The percentage will change based on your tax bracket.

Stop Elimination Of Step Up In Basis Proposal Contact Congress Ditch The Estate Tax

Taxes capital gains as income and the rate is a flat rate of 495.

. Long-term capital gains are for capital assets that have been in the owners possession for more than a year. How much federal tax the estate owes depends on the balance. Some states also have their own state capital gains tax.

In addition to taxes on the value of buildings and land businesses can also pay property. But youre entitled to exclude a total of 500000 of gain from tax if you lived there for two of the five years before the sale. Your average tax rate is 1198 and your marginal tax rate is 22.

The interest income is not taxable by California and has a source in your state of residence. The estate taxes must be paid first from the estate. Section 1231 gains and losses retain this.

Idaho Capital Gains Tax. As the Idaho Legislature considered several laws restricting abortion in the past two years leaders from at least one faith group have advocated for the passage of these laws. If Section 1231 gains exceed Section 1231 losses the gains receive capital gain tax treatment.

The tax base and allowable expenditures vary depending on the design of the gross receipts tax. It is not just opponents of a capital gains tax who call it an income tax. Capital gains tax rates have fallen in recent years after peaking in the 1970s.

Currently the maximum capital gains rate is 20. This marginal tax rate means that. In a petition requesting to appear as an amicus curiae in the cases before the Idaho Supreme Court the Diocese of Boise stated that they see Idahos anti-abortion laws as a critical part of their faith.

New Mexico Taxation and Revenue. If you and your spouse sell your house at the time youre getting divorced the capital gains tax applies. Capital Gains on Sale of Property.

Every tax authority in the country calls a capital gains tax an income tax. Joint filing increases your ability to exclude gains. As of February 2021 the following states do not charge their own capital gains tax.

The tables above show the standard deduction amounts and maximum capital gains exclusions for the 2018 tax year. However certain types of capital gains qualify for a deduction. State income tax but no capital gains tax since they are subject to deduction.

Any estate thats worth less than 117 million does not owe estate tax. The rate reaches 693. Taxation for long-terms gains falls somewhere between 0-20 depending on which tax bracket you fall under.

Rather it is a percentage of the profit. Any amount over the 117 million however is taxable. The first capital gains tax was introduced along with the first federal income tax legislation in 1913.

Of course being tax related your basis is not always simple to figure out. States have an additional capital gains tax rate between 29 and 133. When selling a home if the property has increased in value as a single person you can only exclude 250000 in capital gains from your income.

Short-term capital gains are for capital assets that have been in the owners possession for a year or less which means that they are taxed as normal income. Short-term capital gains tax rates are generally higher than long-term capital gains tax rates. If you make 70000 a year living in the region of Colorado USA you will be taxed 11001.

Proponents of maintaining a relatively low capital gains tax rate argue that lower rates make investing more. This is done to encourage investors to hold investments for a longer period of time. Capital gains are taxed as regular income in Idaho and subject to the personal income tax rates outlined above.

New Mexico doesnt have a capital gains tax Note. Just like with income tax the capital gains tax is not a flat fee. Proceeds from a reverse mortgage loan are usually tax-free and not a penny of the loan needs to be paid back if the borrower stays in the home pays property taxes and homeowners insurance and covers maintenance expenses.

That changes though if you sell or move out of the home or if you or in certain cases your spouse die. As we continue to look at tax types that can harm states post-coronavirus recovery its worth highlighting taxes on business inventory. Ohio and Oregon have flat rates of 026 percent and 057 percent respectively.

Texas Margin Tax allows for a choice of deducting compensation or the cost of goods sold. For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any. The IRS offers an estate tax exemption.

If youre selling a property for a considerable. Idaho axes capital gains as income. In 2017 people in the 25 to 35 range will pay 15 on long-term capital gains while those in the 3960 bracket will pay 20 You can check out Charles Schwab Cos 2017 table here.

A majority of US. Theres good news though. The rates listed below are for 2022 which are taxes youll file in 2023.

Inventory taxes fall under the umbrella of the property tax which is the largest tax paid by businesses at the state and local levels. How do These Tax Policies Apply to Massachusetts Specifically. If You Sell Together.

Real property that is held for at least one year is eligible for a deduction of 60 of the net capital income that is the net gain after.

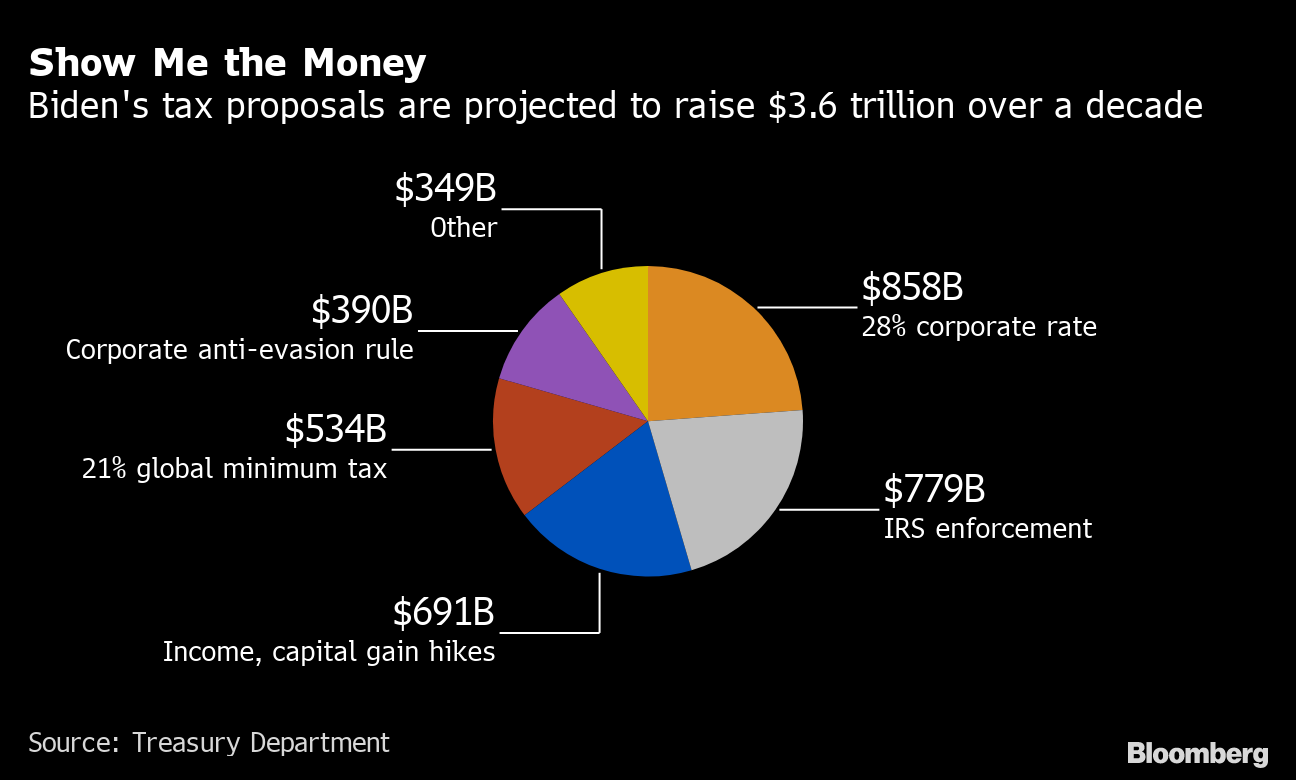

Biden Tax Hike Treasury Forecasts Plan To Bring In 3 6 Trillion Over Decade Bloomberg

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Avoid Capital Gains Tax Idaho Mammoth Financial

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Idaho Inheritance Laws What You Should Know Smartasset

Where S My Refund Idaho H R Block

Washington State S New Capital Gains Tax An Introduction Washington News

Idaho Senate Candidates Raise Nearly 900k Ahead Of May 17 Primary Election Idaho Capital Sun

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep